Put Your Money To Work; Understanding Investing – Peter Kwadwo Asare Nyarko

Growing up, most of us were taught that you can earn an income only by getting a job and working. And that is exactly what most of us do.

There is one big problem with this; “if you want more money, you have to work more hours.” However, there is a limit to how many hours one can work in a day, not to mention the fact that having all the money is no fun if we don’t have the leisure time to enjoy it.

That’s why I’m a strong advocate for investment planning. I recommend you start investing. Put money to work.

I mean you should let your money do the work for you.

“Your money must work hard for you as hard as you work.”

With investment, instead of creating duplicate of yourself to increase your working time, which is not possible; you need to send an extension of yourself that is your money to work. That way, while you are putting in hours for your employer, or even sleeping, reading the newspaper, studying in college, or socializing with friends, you can also be earning money elsewhere.

Saving money is not the same as investing it. Savings accounts pay interest and are usually guaranteed to be safe.

However, when you factor in the effects of inflation, taxes, and the low income yields associated with savings plans, it’s easy to see that you probably will not earn enough to achieve your financial goals through a simple savings plan. That’s why wise investing is the best way to achieve financial independence and financial security.

Choices regarding investments affect every aspect of financial life: financial independence and retirement (FIR), major expenditures, taxes, insurance, and estate and gift planning. There’s no way to avoid the impact of investment decisions, even if we choose not to be directly involved in the world of investing.

The prices paid at the gas pump and at the grocery store, the interest on credit cards, the value of real estate, the cost of

healthcare — all of these are affected by somebody, somewhere, making investment and financial decisions.

Since it is impossible to completely avoid the investment issue, what’s the smart thing to do?

Learn as much as possible about investing and the nature of your options, develop your approach to investing, and begin implementing your investment plans.

“Be patient. If a get-rich quick scheme seems too good to be true, it probably is.”

To make sound investment decisions, you will need to understand that investing is expending money, time or assets with the expectation of achieving a profit.

As in life, achieving a profit from investing is never for sure; so investors beware. Have a plan, do your research and don’t risk more that you can afford to lose.

Common Mistakes to Avoid in Investment Planning

- Unorganized finances

- Investing without clearly defined objectives & a plan

- Not understanding your current or potential investments

- Not understating you or your spouse/partner’s risk tolerance

- Not researching fees & costs associated with yourinvestments

- Improper asset allocation

- Insufficient diversification

- Being sold investments instead of finding them

- Selling in panic

- Not using principles of compounding/time value of money

- Not using investment advisors wisely

- Not getting a second opinion on major investment decisions

- Procrastination

Always remember, money investing even a little can make a huge difference over time.

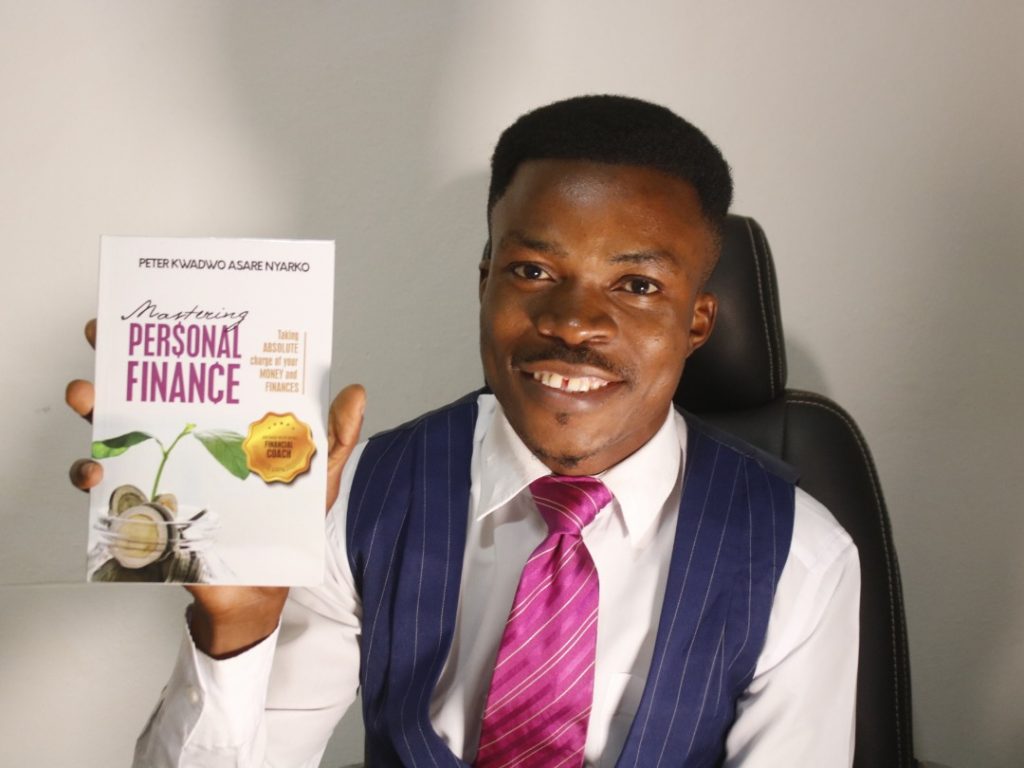

Have you read a PKAN book yet?

You can purchase it from here;

Contact/Email: peternyarko403@gmail.com