- Mon - Fri: 8.00 - 17.00

- +233 27 855 3887

Opening Comments

Most of us are not taught at home or school about planning for our future and why it’s important to have current financial, estate and gift plans to protect ourselves and our families.

We have a collection of serious problems resulting in a high percentage of poverty. Moreover, we have a lack of financial awareness resulting in a serious financial illiteracy epidemic. This places a HUGE growing amount of pressure on families and friends, employers, nonprofits; as well as the ultimate safety net the government. This is not just a local epidemic it’s an international one.

Earning and building personal wealth and managing personal finances today are more complicated and more important than ever. We’re living longer and need to earn more, save more, and invest more wisely to build financial resources to care for ourselves and families. Many of us are insecure with our work and the future of our homes. We see our money being drained by the high cost of food and water, healthcare, housing, education, and taxes while dealing with the uncertainty of investments in our local and global economy.

We worry about the future, or unfortunately in many cases, simply try not to think about it.

Most of us are not taught the essential principles to smart money management – the foundation to personal finance knowledge – at home or in school. Thus, we don’t have the proper tools to address everyday money decisions in an informed manner. This jeopardizes our financial and physical wellness, our ability to realistically achieve and maintain our personal and family financial dreams, let alone enjoy a financially secure debt free future.

The following is our Gift to YOU of Personal Finance Knowledge to you

Questions to Ponder

Managing your personal finances today is more complex—and more important—than ever. To help determine your personal financial awareness and financial literacy answer the following ‘Yes’ & ‘No’ questions. Then total your ‘Yes’ answers below, turn the page and see how you did.

How did you do?

If you didn’t score well, not to worry as we will be sharing the knowledge needed to ace it next time!!!

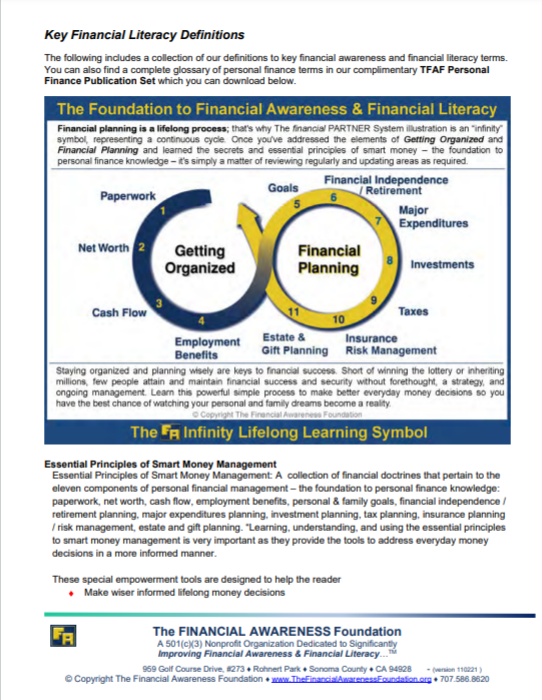

Key Financial Literacy Definitions

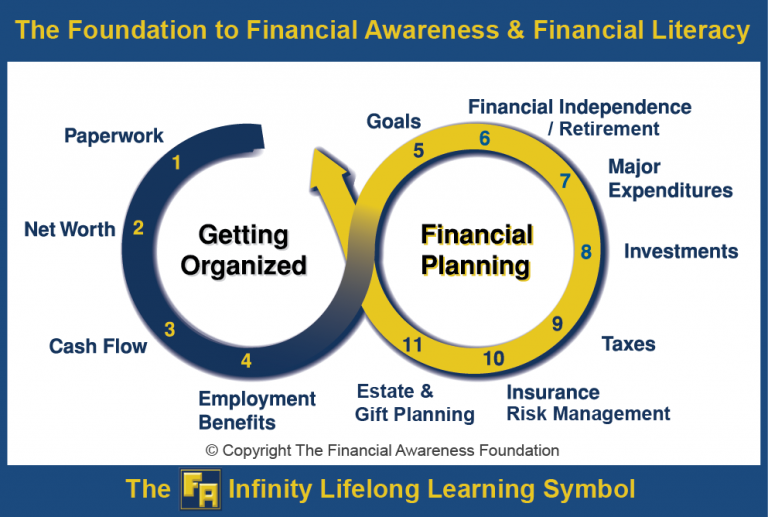

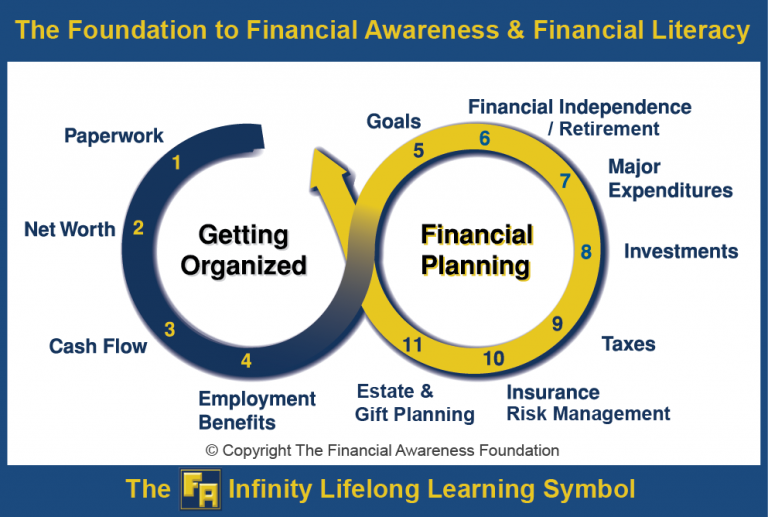

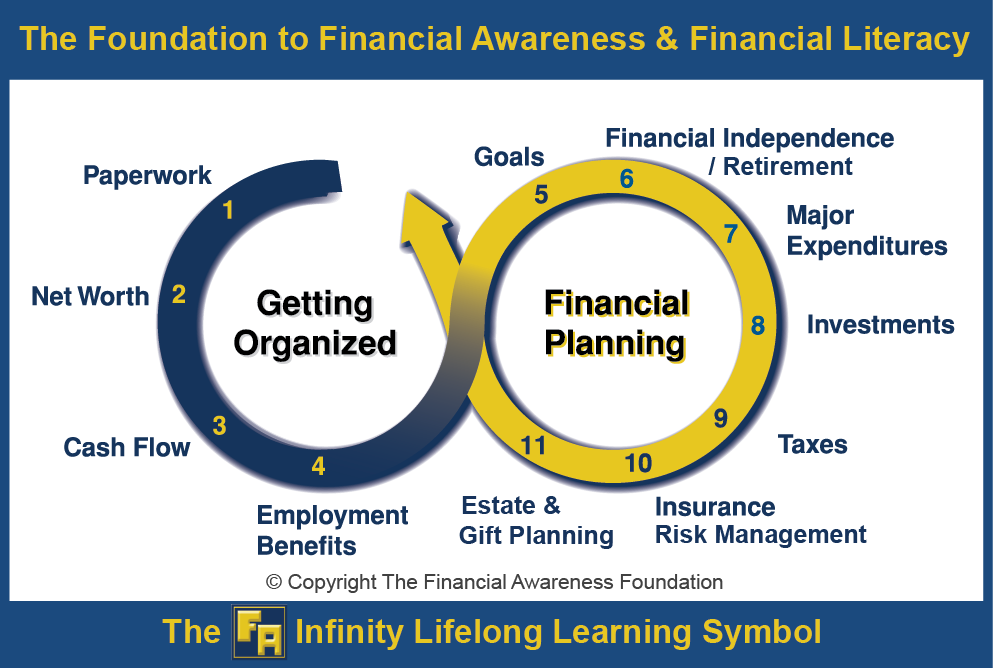

Financial Planning is a Lifelong Process

a lifelong process;

That’s why The FA Infinity Lifelong Learning Symbol is illustrated as an “infinity” sign, representing a continuous cycle. Once you’ve addressed the elements of Getting Organized and Financial Planning and learned the secrets and essential principles of smart money – the foundation to personal finance knowledge – it’s simply a matter of reviewing them regularly and updating areas that require attention.

Staying Organized & Planning Wisely are Keys to Financial Success

Short of winning the lottery or inheriting millions, few people attain and maintain financial success and security without forethought, a strategy, and ongoing management. Learn this powerful simple process to make better everyday money decisions so you have the best chance of watching your personal and family dreams become a reality.

Below you will find a sampling of Improving Financial Awareness & Financial Literacy tools, content, articles and publications for:

- You & Your Family – to better manage and build wealth for a better life

- Financial Advisors & Financial Product Providers, & their Organizations, such as attorneys, accountants, bankers, trust officers and private fiduciaries, realtors, insurance brokers and agents, investment brokers and agents, wealth managers, financial advisors, benefit by acquiring new business from more informed and motivated clients

- Government Officials, Employers & Association Leaders – to help solve a major social challenge revolving around the Lack of Financial Awareness along with the Financial Illiteracy Epidemic while growing the economy and reducing social welfare costs.

- Universities & Colleges –to help them financially educate students, faculty and staff, and alumni, to make lifelong informed money decisions so they are less financially stressed, more productive at work, and live out enjoyable successful lives. This will also lead to them being more philanthropic with increased donations, planned gifts, and bequests to their schools and other worthy causes.

Planning & Managing Your Movement 2014 Team Leaders & Stakeholders

Following are links to a collection to Guides and Planners to assist you and your team in planning, developing, implementing, and managing The Movement in your Country, Municipality, University, Community or Organization. As every situation is unique please use these materials as a model and feel free to innovate as Following are links to a collection to Guides and Planners to assist you and your team in planning, developing, implementing, and managing The Movement in your Country, Municipality, University, Community or Organization. As every situation is unique please use these materials as a model and feel free to innovate as you see appropriate for your situation. Should you have any suggestions or questions please do not hesitate to reach out to us for further input or suggestions or to discuss the matter further. Cautious: Improving financial awareness and financial literacy can be contagious.

TFAF-TIFA-FLM Comprehensive Implementation Tool Kit

This is a comprehensive tool for municipalities, major stakeholders, universities, team leaders, strategic partners and major volunteer groups to master plan The Movement in your Country, Municipality, University, Company or Organization.

Soft Launch Implementation Plans

For launching yourThe Improving Financial Awareness & Financial Literacy Movement with its semi-annual personal finance content media blitz around the strategic campaign venues celebrating April – Financial Literacy Month & October – Estate & Gift Planning Awareness Month

The Improving Financial Awareness & Financial Literacy Movement – Worldwide

Here’s an inventory of The Improving Financial Awareness & Financial Literacy Movement – Worldwide participating countries with a link to their Executive Summary / Overview

The Improving Financial Awareness & Financial Literacy Movement in Africa – Concept Note

Here you will find an Executive Summary and Concept Note for The Movement in Africa

Sample Reports & Itineraries

The Improving Financial Awareness & Financial Literacy Movement Report & Magazine™

The Movement provides a sampling of the community participation, including supporting proclamations from more than 20 US state governors, leading financial service, planned giving, and nonprofit associations and their professionals, a comprehensive collection of reports including how financially literate each state and country is, and what they are doing and so much more.

Gift of Personal Finance Knowledge

We believe that EVERYONE needs to be financially aware and financially literate to make better informed everyday money decisions. If not, how are you going to have any chance to

- Make wiser informed lifelong money decisions?

- Live a quality life without outliving their wealth?

- Watch personal / family dreams become a reality?

- Enjoy a financially secure debt free future?

- Work more efficiently with financial professionals & product providers to get the best results from time & money?

- Get and keep their financial house in order by having a current financial, estate and gift plans?

- Pass on your values, knowledge and assets to future generations, and your charitable causes, to help make this a better world?

- Have the highest probability to reach and maintain your family dreams while you live out a financially successful life?

Here’s your FREE copy of TFAF Personal Finance Publication Set – that includes smart money secrets and the essential principles to smart money management – the foundation to personal finance knowledge – while providing you with a systematic approach to managing your finances over your lifetime.

This will be followed by a collection of videos, articles and other tools all based around The FA Infinity Lifelong Learning Symbol and the essential principles to smart money management.

Publications

Here is your FREE copy of the TFAF Personal Finance Publication Set – that includes smart money secrets and the essential principles of smart money management – the foundation to personal finance knowledge.

Your financial PARTNER Overview – Essential Principles to Smart Personal Financial Management

Identifies the essential principles of smart personal financial management and common mistakes to avoid, as well as an overview of the Your financial PARTNER System.

Date Written 2024

Your financial PARTNER Guidebook

Be more confident about your financial future! A ‘Life Changing’ Book that is a complete personal financial management system which is a clear step by step process designed to help organize your financial affairs and learn the essential principles of smart financial management to help make your dreams a reality.

Date Written 2024

Your financial PARTNER System Forms Set

Included with Your financial PARTNER Guidebook are over 50 unique forms to help you record all your essential financial data, and plan your financial future to help make your dreams come true.

Date Written 2024

Your Estate & Gift Planning Organizer

All the tools you need to better organize, plan and manage your estate plan. Organizing financial information is challenging for most of us. Your Estate Planning Organizer streamlines the estate and gift planning process, helping you prepare and manage your estate and gift plan in a quick and easy manner saving you time and money.

Date Written 2024

Financial Tidbits in 2 Minutes

Financial Tidbits in 2 Minutes

Our series of bite sized video financial presentations focuses on how to get and stay financially organized and how to successfully financially plan for our future

Key Articles

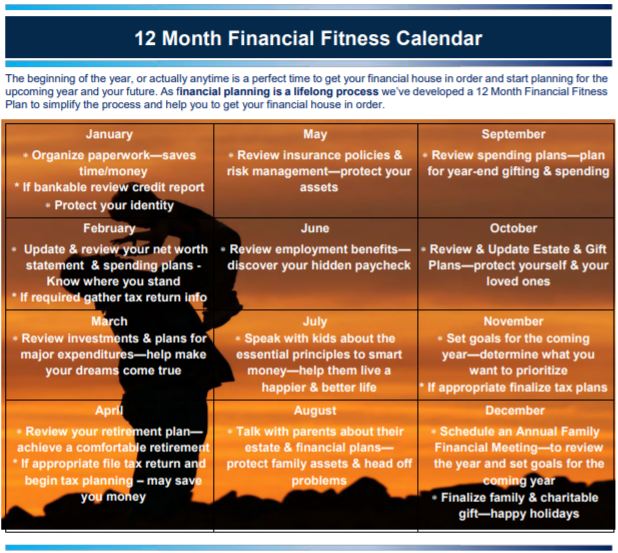

12 Month Financial Fitness Calendar

Personal finance doesn’t have to be daunting or overwhelming; try the TFAF-12 Month Financial Fitness Plan This can be used in a similar way at the Questions to Ponder noted above. In the spirit of improving financial awareness and financial literacy you are welcome to put this on your own letter head.

Date Written 2021

Organization & Planning are YOUR KEYS to Financial Success

Managing personal finances today is more complicated and more important than ever. We’re living longer, but saving proportionately less. Scores of us feel less secure in our jobs and homes than we did in the past. We see our money being drained by the high cost of housing, taxes, education, healthcare, etc.

Date Written 2021

Getting Organized: Time to Get YOUR Financial House In Order

Getting and keeping your financial house in order is an important ongoing household task, but in these changing financial times it’s particularly important. With all the financial uncertainties you want your important paperwork and digital files readily accessible.

Date Written 2021

Let Financial Planning Make YOUR Difference

Unless you are lucky enough to win the lottery or receive a substantial inheritance, very few people can really attain and maintain financial security without forethought and a strategy—a financial plan.

Date Written 2021

It’s Time to Protect YOUR Family & Your Future

Most of our adult population does NOT nor realize the importance of not having a current or up-to-date estate and gift plan to protect themselves and their family’s assets; that can include half your family, friends, and associates.

Date Written 2021

Exposing Kids to Personal Finances

It’s very important for us parents, to introduce and expose our children to sound principles of personal money management. With our media enriched environment, we’re constantly exposed to thousands of marketing suggestions on how to spend money, whether we have it or not.

Date Written 2021

Cost-Cutting Money-Making Game

Personal cash-flow management and managing your spending habits are key areas of personal financial management, and are concerns for many families. With fantastic new products arriving in the market daily, managing available cash becomes quite a challenge.

Date Written 2021

Starting Your Own Business

Before starting a business, consider some of the advantages and disadvantages of heading down this path.

Date Written 2021

Financial Advisors / Product Providers – Select Carefully

Financial advisers / financial product providers and their firms can play a very important role in helping you reach and maintain your financial goal

Date Written 2021

Creative Thinking

We believe that NOW is the TIME for some CREATIVE THINKING for you and your family – for dealing with the Medical Crisis and emerging Economic / Financial Crisis!!! From a personal, business, local, national and global perspective.

Date Written 2021

Video Presentations

Building Blocks to Successful Financial Planning Presentation Series

Here is an enlightening set of presentations by a moderator and panel of experienced financial service professionals. It is designed to motivate, educate and empower you to make better informed lifelong personal financial decisions and to improve your financial lifestyle. Providing you with an easy-to-use, systematic approach to personal financial management. It also introduces you to the essential principles for smart personal money management and the common financial mistakes to avoid; the foundation to personal finance knowledge.

In the spirit of improving financial awareness and financial literacy you are welcome to share this with your family and friends and colleagues. These special empowerment tools are designed to help the reader

Make wiser informed lifelong money decisions

Live a quality life without outliving their wealth

Watch personal / family dreams become a reality

Enjoy a financially secure debt free future

Work more efficiently with financial professionals & product providers to get the best results from time & money

Get and keep their financial house in order by having a current financial, estate and gift plans

Pass on your values, knowledge and assets to future generations, and your charitable causes, to help make this a better world

Have the highest probability to reach and maintain your family dreams while you live out a financially successful life.

eLearning

Certificate of Completion

Resources

FREE FINANCIAL LITERACY AND EDUCATION RESOURCES

- The Improving Financial Awareness and Financial Literacy Movement in Ghana Executive Summary (download link)

- It is Time for Some Creative Thinking Solutions. CFLE Africa and TFAF Creative Thinking Solution Concept Paper (download link)

- Planning Thought-List for the Corona Virus Health Crisis & Economic/Financial Crisis ( download link)

- Financial Awareness and Financial Literacy Community Outreach at Madina Market, 30th April 2021

- Watch Financial Literacy In Ghana on TV3 New Day by our Executive Director, Peter Kwadwo Asare Nyarko and Berla Mundi

- THE PKAN MANDATE - LESSONS @27 (download link)

- #The Story: Financial Literacy Education

- Gift and Estate Planning Awareness Month Campaign

- The Improving Financial Awareness and Financial Literacy Movement in Ghana Documentary 1

- Official Launch - Estate & Gift Planning Awareness Month Part One

- Expert Digest: Estate & Gift Planning

- Expert Digest: Estate & Gift Planning with Mr. William Damitia

- The Improving Financial Awareness and Financial Literacy in Ghana Documentary 1

Gallery

PKAN Books

Journey To Financial Freedom

Building a strong financial foundation and investments basics.

Mastering Personal Finance

Taking absolute charge of your money and finances.

Teaching Children Financial Freedom

A complete financial literacy guide for parenting.