Let FINANCIAL PLANNING Make Your Difference

Unless you are lucky enough to win the lottery or receive a substantial inheritance, very few people can really attain and maintain financial security without forethought and a strategy—a financial plan.

The beginning of the year is always an excellent time to review and update your existing financial plans or start the process if you have not done so yet.

The process of financial planning does not have to be intimidating or a difficult task. In simple terms, a financial plan is whatever strategy you set up for yourself and your family to meet your personal and financial goals, needs, and obligations.

The most successful financial plans are personal in nature. They are based on your own goals, values and lifestyle choices; they even reflect your personality.

Are you aggressive by nature that is a risk lover? or are you a risk averse?

Would you rather own individual stocks and bonds or mutual funds, or than leveraged real estate or fine art?

Do you like to work with and rely on professional advisers or talk with a lot of people before making a decision, or do you prefer to do your own investigation and come to your own conclusions and use financial service providers for validation and second opinions?

It is important that you understand the steps you will need to take in putting together a winning strategy to reach and maintain your financial objectives, regardless of your goals or personality.

The subject matter of comprehensive financial planning is very broad, and its areas of expertise overlap. Accountants, attorneys, bankers, insurance agents, investment advisers, realtors, stock brokers, trust officers and others can act as financial advisers and planners. Each of them emphasizes a different aspect of your financial life.

This is another reason financial plans can take many different forms.

Comprehensive financial planning, estate and gift planning involves many factors, which can seem complex and confusing, if you do not know the essential principles to smart money management and how to use them, you may not even try. Armed with this knowledge, financial planning can be very rewarding to you and your family, as you see yourself progressing toward your financial goals.

Once you get yourself financially organized you need to do some serious (and playful) thinking about your future, your personal and financial goals.

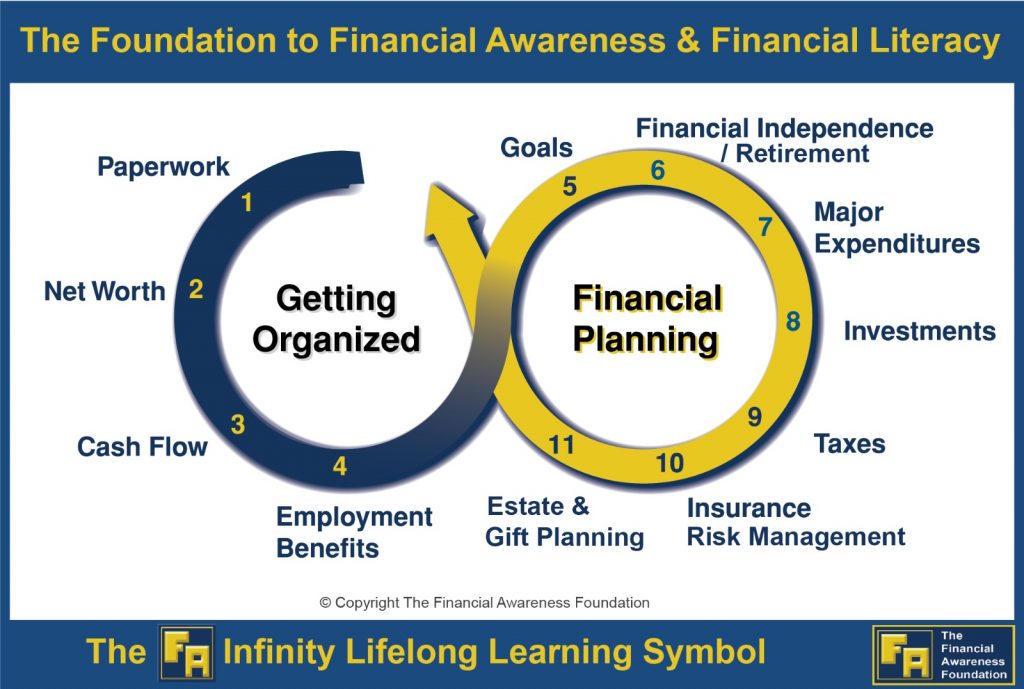

Then there are six major areas of personal finance to be addressed in your financial planning. This is presented in the yellow ring of the infinity sign in the 11 step process. They include

- Financial Independence & Retirement

- Major Expenditures

- Investments

- Taxes

- Insurance / Risk Management

- Estate & Gift Planning

WHY DEVELOP A FINANCIAL PLAN?

The economics of living today’s are more complicated than in previous generations. COVID-19, uncertainties of the job market, changing economic markets, increases in costs of living, questions about government programs, and the need to support yourself and family over a longer life span are real concerns.

Developing a comprehensive financial plan will address your financial situation now while giving you a real sense of security as

you follow your advancements for your future. It will also help you:

- Make wiser informed lifelong money decisions.

- Determine what has to be done and achieved to realistically meet your financial goals.

- Recognize bad advice and avoid financial pitfalls.

- Work more efficiently with financial professionals & product providers to get the best results from time & money.

- Pass on your values, knowledge and assets to future generations and your charitable causes to help make this a better world.

- Have the highest probability to reach your family dreams while you live out a financially successful life.

You do not need to become a financial expert to create and carry out a solid financial plan. You do need to develop the assertiveness to ask questions and the willingness to listen until you understand the answers. And you must make the commitment to take appropriate timely actions.

SIX EASY STEPS TO YOUR FINANCIAL PLANNING

At first glance, financial planning can seem complex and confusing, and if you do not know how to sort it all out, you may not even try. Armed with a systematic approach for addressing your financial planning, you will be in the best position to progress toward meeting your personal and financial life goals.

As noted above once you have done some serious and playful thinking about and have written out your goals, both personal and financial now the planning begins.

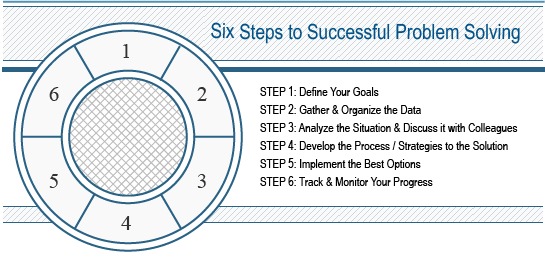

To assist you with this process here is an easy to use six-step process for analyzing and planning each area of your financial life. This approach will guide you in a logical progression toward establishing, understanding and meeting your goals:

Step 1: Define Your Goals: State your financial goals in writing as concisely and specifically as you can.

Step 2: Gather & Organize Your Data: Make sure your financial information is organized so that your current financial position is clear.

Step 3: Analyze Your Situation: Look at your current financial position. Are you meeting your goals, or are you falling short?

Step 4: Develop Your Strategies: Identify plans that will help you achieve your goals in the most efficient manner.

Step 5: Implement Your Plan: This is your action step. That is, put your plans into action. Take definitive measures to achieve and maintain your goals.

Step 6: Track & Monitor Your Progress: Check your progress on a monthly, quarterly, semi-annual or annual basis, depending on which of the areas of your personal finances you are addressing.

Using this six-step approach to financial planning gives you a systematic process to effectively address and best manage your personal financial affairs and provide you with the best probability of success.

TAX PLANNING WEBINAR

Join the Financial Literacy Month webinar series on Tax Planning Essentials & The Ghana Tax Laws with Deloitte Ghana.

Saturday, 23rd April, 2022, 4:00pm GMT

Webinar Link:

https://us02web.zoom.us/j/7598371756

Webinar ID: 759 837 1756

PASSWORD: TFAF

Happy Financial Literacy Month!

Please share! Thank you.