Planning Your Finances For The New Year

Now that the new year is here, many of us have committed ourselves to changing the way we live for the better. Some of the most important things people focus on, especially in the new year, are personal finance, saving, and investing.

Achieving financial freedom and independence is an admirable goal, but very few people know where to start. If you’re starting to take steps towards financial

freedom this year, here are some tips you should follow to set financial goals for the new year.

Personal Assessment

Setting financial goals is crucial, but before you can set any goals, you need to know where you currently are. Look through your savings, debts, and investments. Assessing your financial status may feel stressful, but gaining this knowledge will allow you to set realistic goals for the year.

Budget and Stick to it

One of the best things you can do for your finances is set a budget. The budget should be achievable. Make sure that your housing, food, and utility costs are around what you usually pay. Make a decision to spend less than you earn or earn more than you spend this year.

Pay Off Your Debt

Debt is a significant burden and can prevent you from achieving your financial dreams. Start paying off your debts now. Interest is stealing your money from you. If you’re making 15% in the stock market, but paying 18% in interest, you’re losing money.

Commit to paying off debts now, and you’ll be able to keep the money that you invest in the future.

Plan for Retirement

Retirement

is coming, and you should be preparing for it. You need to discover

exactly how much you need to retire. Thankfully, I run a seminar

on planing

for the future. Watch

out as we roll out this important program this year.

Knowing

your number will help put your savings into perspective.

Planning for retirement is always an excellent financial goal, and the new year is the best time to focus on it.

Stay Organized

Setting budgets and goals are great, but these efforts are futile if you do not have a plan to stay on track. Staying organized is a critical step to meeting your financial goals this year. There are several tools and budgeting apps out there that can help you remain on track. When it comes to your personal budget, the more organized you are the better.

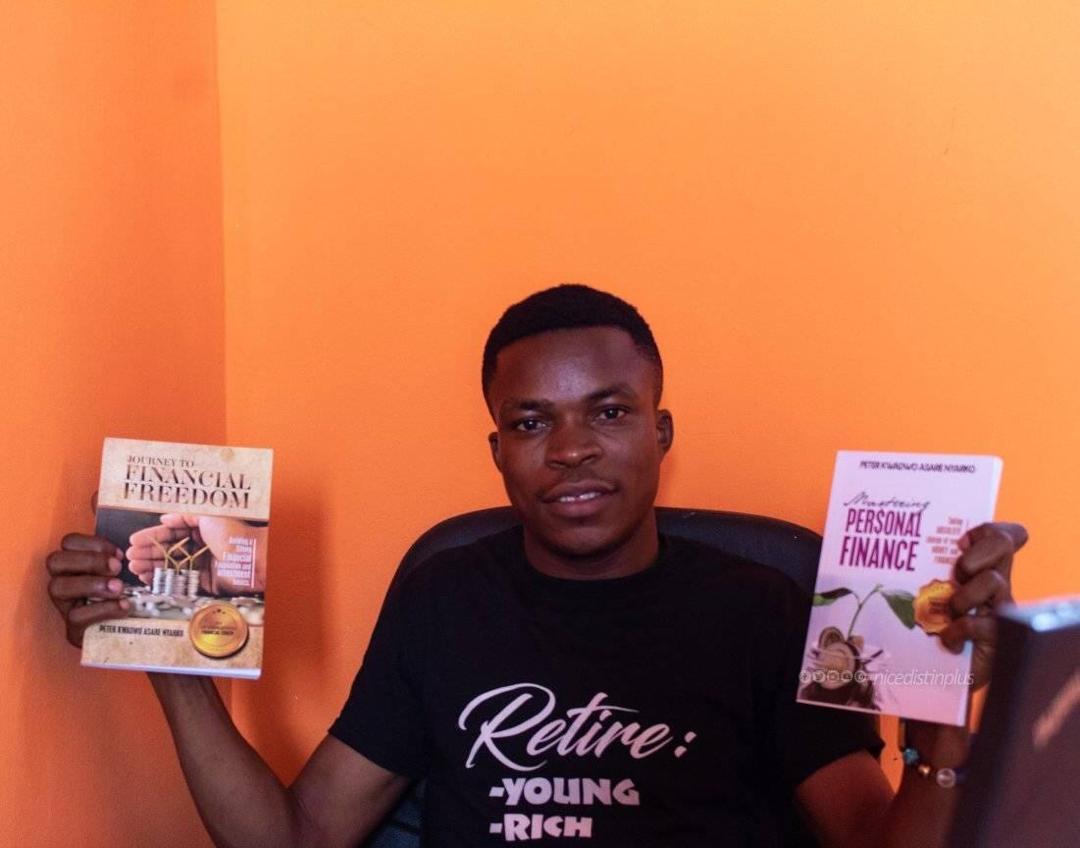

I have written 3 great books on personal finance and

investing. Mastering Personal Finance, Journey To Financial Freedom and Teaching Children Financial Freedom. Grab copies and take absolute control of your financial matters.

Connect

via

www.facebook.com/vimambassador1

www.instagram.com/vimambassador1

www.twitter.com/vimambassador1

WhatsApp: +233278553887

Your financial success and a fulfilling life is my earthly assignment. _Peter Kwadwo Asare Nyarko (Financial Literacy Advocate, Author, Financial Educator)